By Justin Izzo, Content Marketing Manager, DocSend

In order to get their ideas off the ground and grow their businesses over time, most start-up founders inevitably need to secure outside funding. The problem? Fundraising takes valuable time away from running your business, and it can be hard to know how to tell your company’s story in the most compelling way possible. A concise, well-organised pitch deck can mean the difference between a fast funding round raise and having to go back to the drawing board.

But how is a busy founder supposed to know what investors look for in a deck? DocSend’s research gives founders data-driven insights to efficiently pitch investors, which allows them to get back to work growing their businesses.

How DocSend’s data empowers founders

I run DocSend’s fundraising research, which means turning pitch-deck data into actionable insights for founders at varying stages of startup maturity. DocSend’s tracking and analytics allows us to anonymously aggregate data about how pitch decks are shared and viewed on our platform: data collected includes everything from how much time investors are spending on decks to the average number of investors that founders are sending their deck to each week.

In our research, we marry this data from our product with data about founders’ fundraising outcomes. This allows us to show how fundraising trends change over time and to make predictions about what it will look like in the future. Founders, therefore, can stay up to date on what investors really want to know about their startups.

With remote work and virtual investor meetings as the norm, founders need to rely even more on a solid pitch deck to stand out from the crowd—in-person networking isn’t the industry touchstone it once was. What’s more, our data shows that investors spend less than 3 minutes reviewing pitch decks these days. Armed with DocSend’s insights, founders can navigate fundraising more easily, tell their unique stories in concise, attention-grabbing ways and more efficiently connect with investors.

Pitch smarter, not harder.

In working with deck data and fundraising statistics, I’ve learned that even if venture capitalists are hungrier for start-up deals than ever before, they’re still looking to spot some key indicators in each deck: They want to see start-ups that can marry a compelling product idea with a tightly-organised business narrative.

No two companies are exactly alike, and neither are their pitch decks. Nonetheless, quality decks structure a unique story around very similar points, which can be summed up into roughly 12 deck sections within four themed buckets. These include:

A high-level overview of your business: Company purpose, founding team, problem, solution and product overview sections.

Monetisation plans and financial track record: Business model and company financials sections.

Product-market fit: Market size, timing (why now?), traction and competitive landscape sections.

- ‘The ask’: Fundraising goals section

Structure matters (a lot!)

Since most pitch decks are roughly 20 pages long, with about 50 words per slide, every page and section must have a clear message to articulate. If your slide doesn’t clearly speak to one of the 12 sections or four buckets, ask yourself if you really need it. Since investors typically devote only a couple minutes or less to your deck, your best ideas need to grab a reader’s attention straight away. Let’s look at some data from the pre-seed round to see what this means for founders.

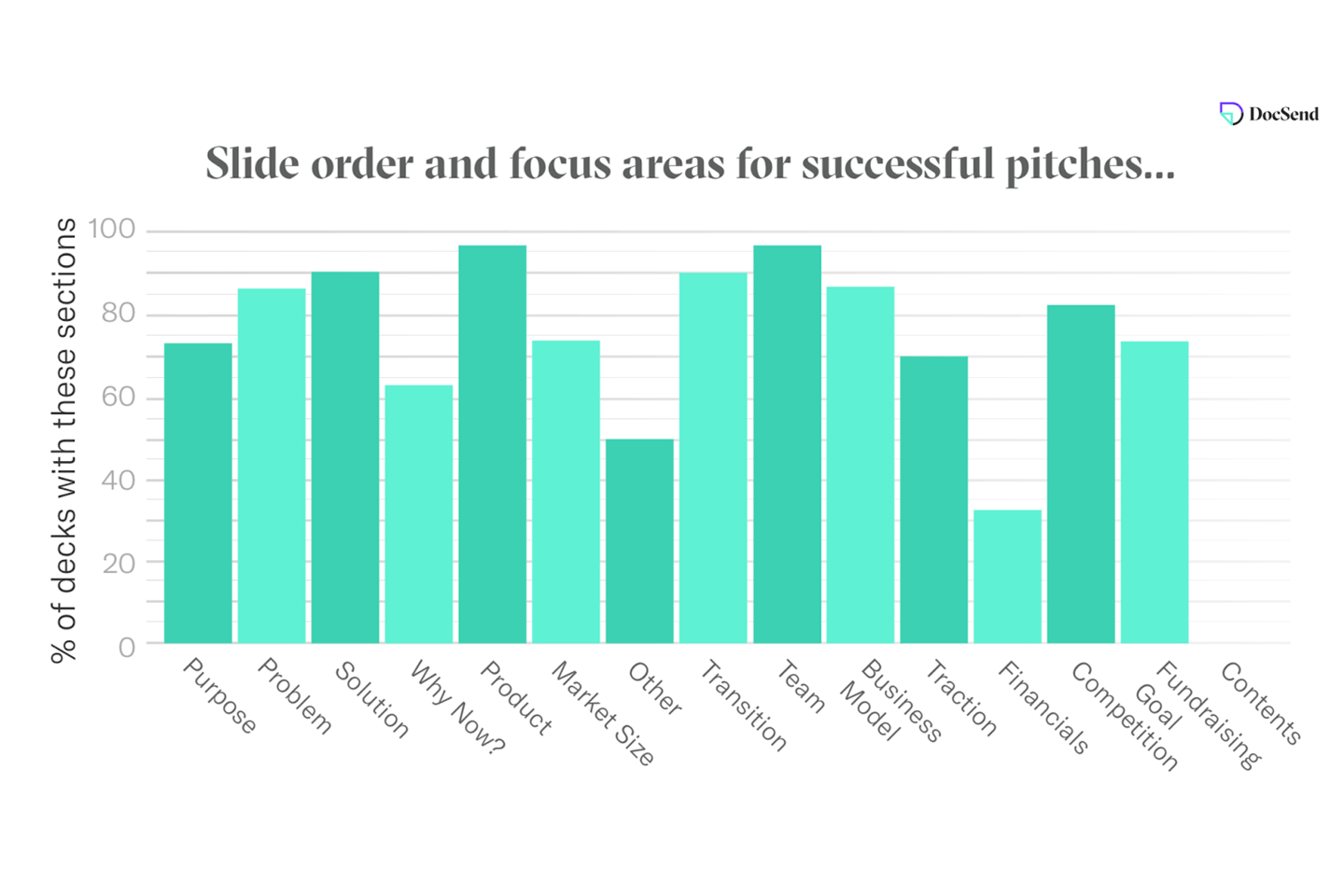

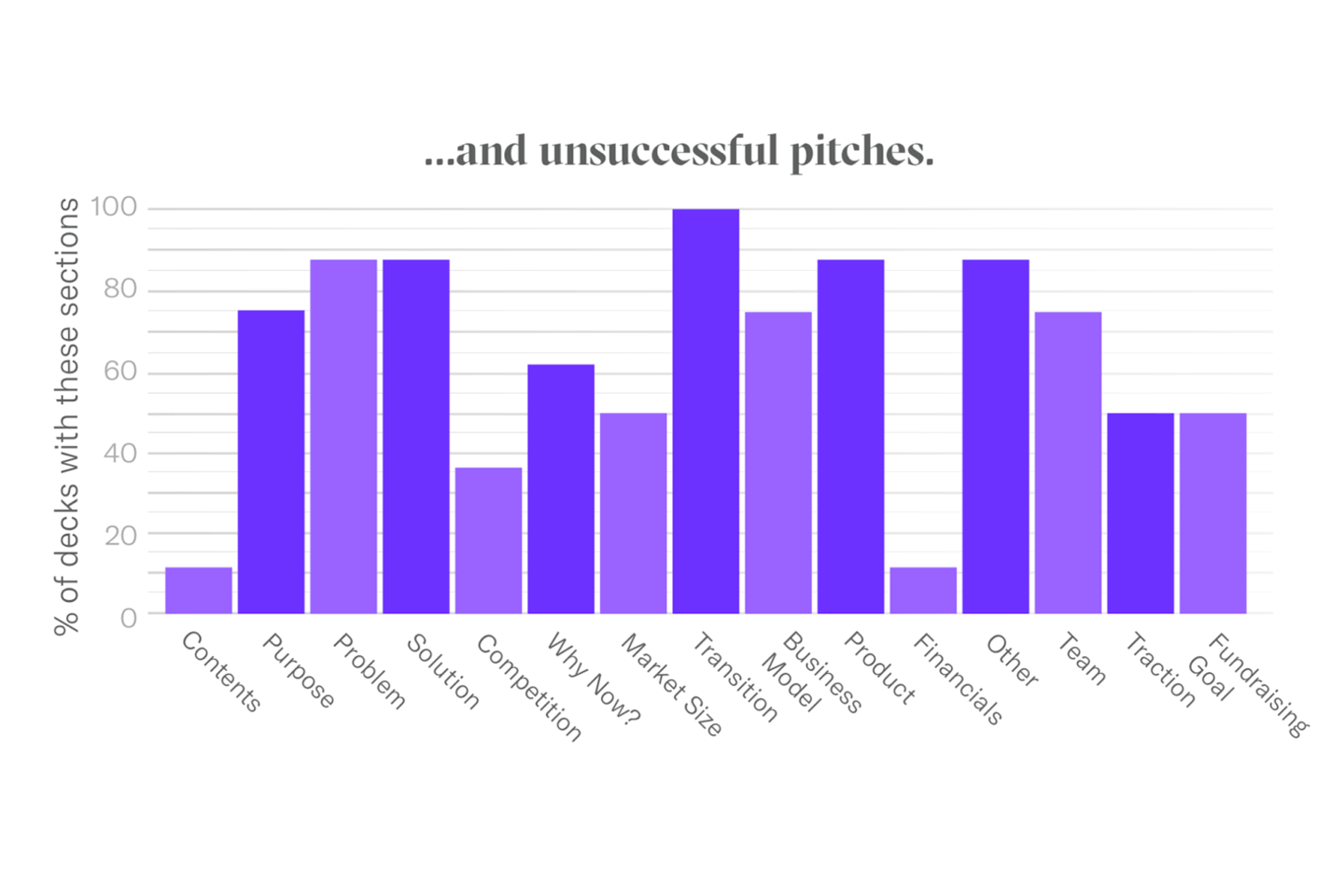

Our data shows that in 2020, investors spent over four minutes looking at pitch decks that successfully raised money, but only one minute, 30 seconds on decks that didn’t manage to raise. This means that busy VCs are bouncing quickly off decks that don’t draw them in from the start. But let’s look more closely at what these decks (both successful and not) actually looked like from a structure point of view and where the most time is spent.

These charts show several key differences between successful and unsuccessful decks. First, none of the successful decks in our dataset had tables of contents, but instead got straight to the point and didn’t bother with any extraneous information. Second, decks that received funding are more likely to place their product sections and ‘Why now?’ sections earlier in their presentation, allowing VCs to more quickly connect to a company’s purpose and the problem being solved. Third, successful decks were far more likely to have sections about their company’s main competition.

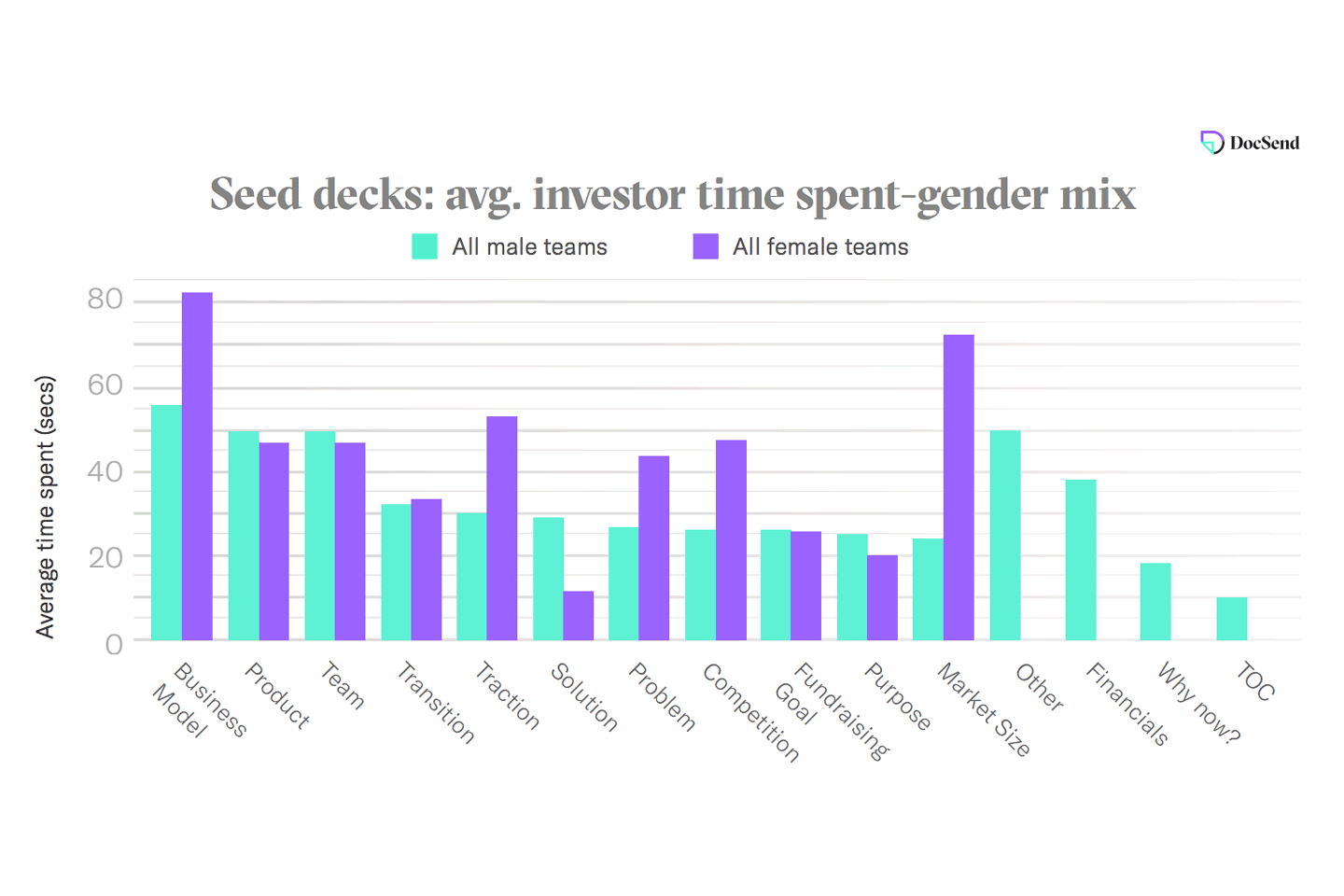

Team demographics can also affect how deck structure matters to investors. Let’s look at a Seed-stage deck breakdown for all-male and all-female teams. Our research found that the business model section is crucial for both teams and where investors spent the most time. But they spent 48% more time on this section for all-female decks. VCs also spent 77% more time on the traction section and 200% more time on the market size section for all-female teams.

The takeaways: Pitch decks should get right to the point with a narrative that highlights the product up front. Importantly, the product section should emerge organically from a company’s purpose, problem and solution sections. These sections also need to clearly indicate why now is the right time to invest in your startup. Keep in mind that, although you may think your idea is revolutionary, the problem you’re trying to solve has likely existed for a long time and investors have seen other people try to tackle it—address this issue head-on. And regardless of your team demographics, it’s essential to explain your monetisation plans and highlight your unique product-market fit. Finally, remember that simplicity is key: Investors will bounce out of a deck if they aren’t compelled early on, so make sure your slides are crystal-clear and not cluttered with needless complexity.

Pay attention to changing investor expectations

Creating a successful pitch deck involves more than just a careful arrangement of deck sections. Keep in mind that the sections that matter to VCs shift over time and change from round to round – what gets founders funded at the pre-seed stage may be completely irrelevant by the time you’re trying to raise a Series A. DocSend publishes annual round-by-round reports that track changing fundraising trends to help founders stay on top of investor expectations.

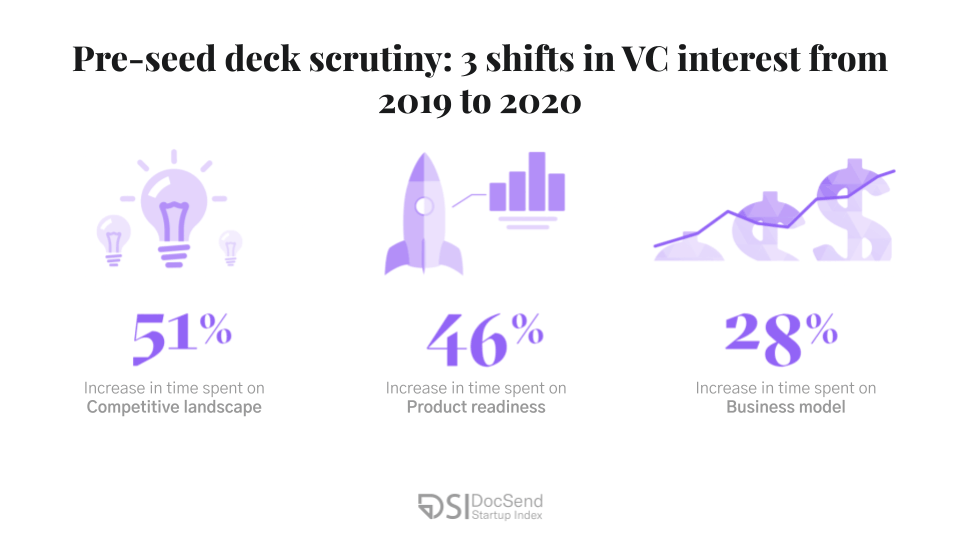

Let’s return to our pre-seed report example to see what this looks like in practice. When analysing data for this report, we noticed that in 2020 investors spent much more time on three deck sections (competitive landscape, product readiness and business model) than they had in 2019.

Taken together, these shifts tell a clear story about how investors changed their deck evaluation behaviour last year. Investors were interested in product readiness (in fact, 90% of all companies in our data set had products at least in the alpha stage), but equally importantly, they wanted to know how companies planned to monetise their products and find room for them in the marketplace. In short, investors were interested in pre-seed companies that had fully-fledged business plans rather than just a good product vision.

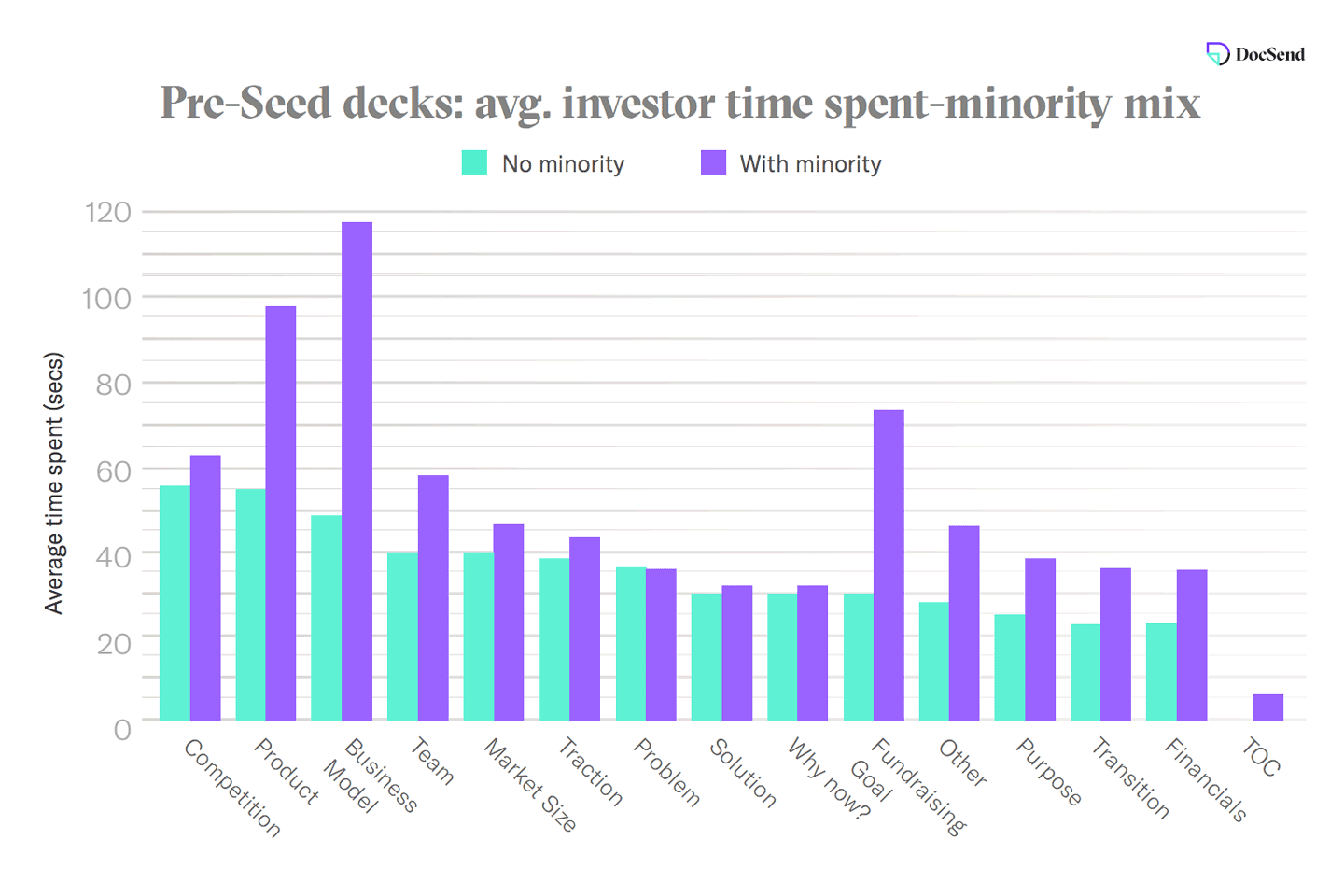

The three shifts we uncovered also show up when we look at team demographics. For teams with and without underrepresented minority members, the competition, business model and product sections remain crucial. However, investors spent much more time scrutinising these sections for teams with minority members.

We found that investors spent 140% more time on the business model section of decks with minority members and 78% more time on the product sections. These different insights into our data show how the pre-seed round has become more competitive than ever – companies can no longer get by with a ‘Minimum Viable PowerPoint’.

Founders need to pay attention to how these expectations change between rounds, too. For instance, the “why now?” slide is crucial for a pre-seed deck but, in last year’s Series A dataset , it didn’t factor among the most-viewed sections. This is because Series A companies should already have traction (and success) in the market and may need to focus instead on scaling their business model.

The takeaways: As your company grows, your company narrative and pitch deck should evolve, too. Investors expect different stories from companies at different stages of maturity. Be sure you understand what kind of progress you need to show before you hit the fundraising trail for your next round. And it doesn’t hurt to stay attuned to the latest fundraising trends.

It’s your story, but our data helps you tell it

Everyone’s fundraising journey is unique but DocSend’s research gives you the building blocks to differentiate your process and pitch deck.

Visit the DocSend site to learn more about the key story points to highlight in your deck, the information investors look out for, how these elements change over time and how team demographics can affect deck scrutiny at various stages. Armed with these insights, you’ll be ready to put your best foot forward to more quickly earn the investment to grow your business.