DocSend’s Startup Index explores changing trends among venture capitalists. Among the findings, the data reveals investors now take just three minutes to think about your deck. And that’s if you’re successful.

Simply put, if your pitch deck doesn’t immediately charm investors, chances are you’ve already missed your opportunity. So, what do investors want, and how do you give yourself an edge?

Join us as we reveal all—and learn how to pitch to investors with our complete guide to creating an unforgettable investment pitch.

What do investors look for in a pitch?

What investors want is a simple, data-driven drill-down on the math of your business—with a clear overview of your ideas. Here are the main criteria that investors will expect:

- Your idea—no idea, no pitch, and another “no” on your (probably) long list.

- Your USP—unless you’ve invented something investors want to know how you’re different.

- Financial projections—DocSend research says granular data is a common demand today.

- A business plan—details on where the money is going, again the more granular the better.

- A top-notch pitch deck—it’s crucial that this is easily digestible and concise.

How to prepare before making a pitch

Identify potential investors

You need to prepare yourself with a solid investor candidate search, which will depend on the type of business you have.

The most important consideration in your search will be the type of investor, which is usually one of the following types:

- Venture capitalists, who provide private equity funding

- Angel investors, who are normally high-net-worth individuals

- Personal investors, who might include anyone within your company network

There are also peer-to-peer investors and, of course, banks.

Assess the current investing climate

After you decide on the investor, you need to look at the current investing landscape. DocSend data reveals the following insights:

- Investors are increasingly more selective

- Investors are shifting their focus from growth to profitability to minimize risk

- Investors are looking for niche underrepresented groups, such as the LGBTQ community

This means the landscape is tougher than ever, and you’ll have to compete even harder for a shrinking pool of funds.

And you’ll have less time to catch investors’ attention. The data shows that from 2022 to 2023, the time venture capitalists spent on successful pre-seed decks was reduced from 2:46 to 2:20. Mere minutes!

Every second counts. And an attention span drop of 20% is only going to add pressure to the situation.

Get your story straight

Now that you know who the investors are and what to expect, the focus can turn to you.

During a pitch, investors will likely have a barrage of questions ready for you, such as:

- “Why this particular type of investment?”

- “What’s stopping you from going to a bank?”

- “Why come to me in particular as an investor?”

You’ll need good answers as to why you want their money specifically. Understand your circumstances, know if you’re an early-stage or a growth-stage startup, if you need pre-seed or seed fundraising—and prepare yourself for questions.

All of this gives you ammo for whatever type of investor you’re pitching. You’re not ready to pitch if you don’t know their priorities, your position, and ultimately how you can make money together.

Build your charisma and confidence

Ever wish you could get an objective view of yourself when you’re getting ready for a big presentation? When you record your screen or yourself to practice your pitch run-through, you can use Dropbox Replay to share your recording with your team. They’ll be able to critique the deck and give you feedback on how to improve the presentation.

How to make a pitch to investors

It’s a lot of work to understand who you’re pitching to and why. So, assuming you have that in mind, we can focus on how to pitch. Use the following tips for a better chance of success.

1. Deliver your elevator pitch

An elevator pitch is the condensed version of all the information you’re about to present. Investors want a roadmap of where you’re heading during the pitch in about 30 seconds.

Make sure your snappy, smooth, but serious elevator pitch can hit the following points:

- The nature of your business, your company structure, founders, and other details

- Your product or service, anything relevant to what your company provides

- Your value proposition, the benefits that your product or service delivers

Above all else, be prepared. You have to be ready to deliver your pitch in any situation. You never know where you might need to explain your idea to a potential investor.

2. Tell your story

Try to share the desire and the dreams that inspired you to start pursuing the idea. Hopefully, when you’re done, they’ll be rooting for you and want to see you succeed.

Everything you say at this stage will require data to back up your claims. Information on audience segmentation, financial projections, and other numbers will help to sell your company story.

So, when planning the story slides of your deck, make sure you include the following:

- The consumer problem or market gap you see

- How your company and the investor's funding will solve this problem

- Your audience or customer base, who your business will help, and how

- Why your business needs funding at this point more than any other

3. Show your market research

Grounding your product in hard data will make it less of an idea and more of a plan. This part of the pitch can create a sense of urgency for the investor, who will see the plan is ready for action.

Make sure you cover the following in your market research slides for a successful deck:

- Competition—demonstrate how competitive your market is. Investors don’t like too much saturation but too little may indicate your plan is unviable.

- Industry status—including market history up to the pitch-and sector projections beyond.

- Audience or target customers—who are they and what are their values, wants, or needs?

- Market growth potential—what is the capacity of your product or service to increase in demand and sales over time?

- How to avoid risks in the market—whether that’s legal, regulatory, or other potential pitfalls.

4. Introduce and demonstrate your product or service

While an investor will broadly understand the product at this stage, it’s time to get into some detail. The most important thing is some kind of demo, where the investor will see, try, or use the product or service.

A demo in a pitch for a digital service or physical product will require careful preparation and testing. For example, if you’re pitching an app, you’ll want to be absolutely certain that its core functions can be demoed flawlessly during the pitch.

Make sure you iron out any kinks before you get to the pitch, too! An investor wants a real-time experience so you better check and re-check, right up until the moment of truth.

5. Explain the revenue and business model

If your pitch has investors sold on the idea, everything now rests on one factor—the business model. This is the slide that investors will care about more than any other in your deck.

So, aim to include the following details to show how your business will make them money:

- Price points for each product or service

- Fee structure—is it a per-item charge or a monthly/yearly subscription?

- Services or product classes and their pricing, such as a premium plan for business

- How the prices fit into your revenue goals, selling X number of products to achieve Y

- Projections for return on investment, including the amounts and when to expect it

This can be the clincher stage for many investments. Pay close attention here, as astute investors will be aware of irregularities and ask plenty of questions.

6. Clarify how you will attract business

Investors don’t back projects without major audience demand.

You need to keep your approach to acquiring new business and key metrics as the focus of these slides. Make sure you include the following details on how you will attract new business:

- Marketing channels you will use, such as social media, direct sales, digital and traditional PR

- Growth metrics, like customer acquisition cost (CAC), customer retention rate (CRR), and conversion rate

- Sales process breakdown—what is the journey from a lead to a sale for the company?

Investors are looking for growth potential, so they’ll be very familiar with metrics and the different stages of the sales process. Prepare for questions and know the metrics inside out!

7. Pitch your team

Aside from the idea, state of the market, and financials, an investor wants to know that their money is in good hands. You need to sell the merits of your team so the investor can trust your abilities.

The DocSend data demonstrates that both seed and pre-seed decks are more successful when teams are introduced toward the beginning. The fact that decks with team slides toward the end are less successful indicates just how important a team is to investors! Consider moving it up in your deck to make sure you succeed.

Keep the following in mind for a better pitch result:

- Celebrate your team's skills, experience, and qualifications

- Don’t deny any shortcomings you may currently have and explain how you will deal with them

- Chart the next steps, ambitions, and improvements of your team as part of the pitch

8. Explain your financial projections

You need to project your revenue goals over the next three to five years. Break down the revenue per product and be certain to carefully explain how and when the business will see these numbers.

A revenue projection slide should be concise. Make sure you don’t get swept up in numbers. Keep it simple.

9. Justify your fundraising needs

All investors will prefer to give you a lower level of funding if that’s what your idea requires. You have to make investors understand why you need the funding you’re asking for.

Make sure you cover the following to justify what you ask for and to help close the deal:

- Current funding levels, how much you have to date, and where this came from

- Ownership levels—what stake will investors get and what is the current equity distribution?

- How much more investment do you need to achieve your goals?

- Where will the money go and what you will use it for?

- The position of the business, once the funding runs out

This is a good point in the pitch to remind everyone how shrewd and trustworthy you’ll be with the investor's money. Make everyone in the room comfortable with what they’re about to offer.

10. Illustrate your exit strategy

As fundraising progresses from the seed stages, you’ll find investors are eager to know what the exit strategy is for the business. A large company may acquire you, the management might want to buy out the stake—or maybe you’ll go public.

Whatever the exit plan looks like, explain to the investor why it makes sense for the company and what it means for their investment. Investors may not care about the method of exit, but they’ll want to know how they’ll get their money back five or 10 years down the line.

What are some common mistakes made when pitching to investors?

We want to give you a positive list of things to do to make your pitch great, but there are a few things to avoid, too. Try to avoid the following common fundraising pitch pitfalls:

- Not understanding your audience or customer

- Not doing the market research

- Not being transparent with the data you have or your sources

- Not leaving enough time for questions during the meeting

- Not following up with people in the pitch after the meeting

- Not listening to investor feedback or refining your deck after an unsuccessful pitch

Pitching can be a lot of build-up with a whirlwind of activity that follows—or a fast “no.” Prepare for each stage as if it was the final step, which is stepping into the room and delivering.

Nail your next investment pitch with Dropbox

Dropbox makes it easy to share, collaborate, and work on your deck. When your pitch lands the investment you need, DocSend can make sending files quick, simple, and safe.

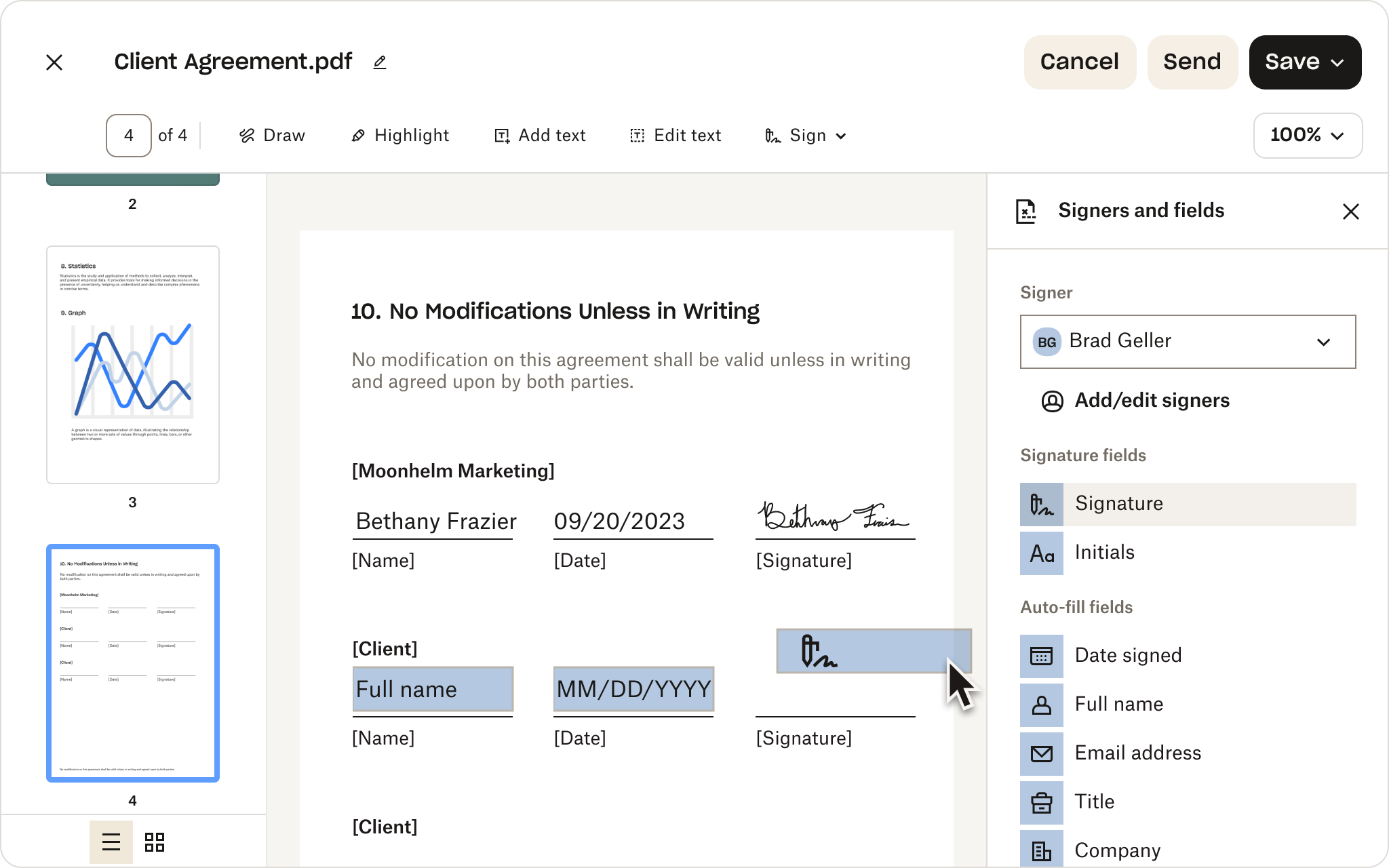

Try Dropbox Replay to gather feedback from your peers on your presentation practice, or the pitch itself. You can also use Dropbox Sign to get legally-binding eSignatures, so whether you’re preparing a pitch or have a winning agreement to send, you can rely on our tools at every stage.

Our practical guide will give you the best chance of success in your pitch. Combine a strong pitch with our powerful products, and you’ll be ready for a “yes” in your funding journey.